Despite a slowdown in clearance rates, Canberra's real estate market is witnessing a notable trend with properties achieving record prices after auction. A prime example is a recently renovated, four-bedroom home in the reputable suburb of Holder. Setting a new suburb...

A Complete Guide To Buying Property In Canberra

A Complete Guide To Buying Property In Canberra

Welcome to our comprehensive guide to buying property in Canberra. Whether you’re a first-time buyer or an experienced investor, navigating the real estate market in Canberra can be both exciting and challenging. In this guide, we will provide you with valuable insights and information to help you make informed decisions when purchasing property in Canberra.

Understanding the Canberra Real Estate Market

- What is the current real estate market like in Canberra?

- Exploring the average property prices in different neighbourhoods of Canberra.

Canberra’s Property Market Performance

The past year has witnessed remarkable growth in Canberra’s property market, with house and unit prices soaring by 12.2% and 11.7%, respectively. This impressive growth outpaces other capital cities, including Hobart and Adelaide, solidifying Canberra’s strong position in the ACT’s property landscape.

Several factors have fueled this market growth, including population expansion, restricted availability of properties, increasing construction expenditures, and robust household incomes.

Median House and Unit Prices

According to the most recent data, the median value of houses in Canberra is currently $828,175, while units have a median value of $595,998. Over the past year, there has been a significant increase of 12.2% in house prices in Canberra, with a notable 1.8% rise in the twelve-month period ending in September. However, the market saw a minor decline in median house prices in September.

The median unit prices in Australia’s capital cities have shown consistent quarterly price growth in the last four months. With a 1.1% increase in May and a 0.3% rise in April, Canberra’s median unit prices have experienced a fluctuation due to a high volume of low-value unit sales and a significant addition of supply.

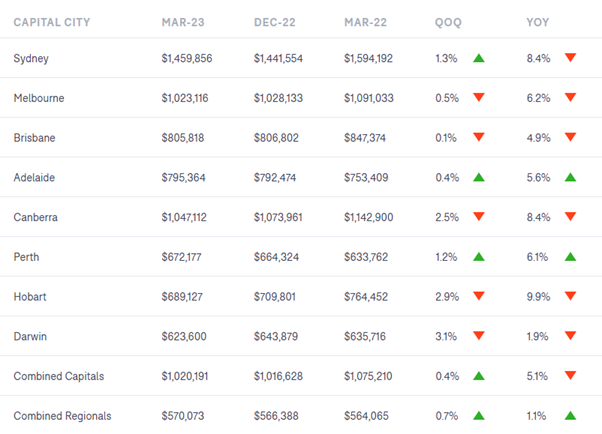

Capital City Comparison

When comparing Canberra’s property market performance to other Australian capital cities, it becomes evident how competitive Canberra is. As of October 2022, the median house prices in Australia’s capital cities range from $731,547 in Adelaide to over $1.2 million in Sydney.

Furthermore, Adelaide’s housing values have seen a 44% increase over the growth cycle, while unit values have increased by a total of 23% during the same period. In this context, Canberra’s impressive market growth stands out.

Factors Driving Canberra’s Market

The property market in Canberra is driven by several factors, with population growth playing a significant role. As more people move to the area, the demand for housing increases, resulting in higher house prices. Additionally, limited supply contributes to price increases as the availability of properties becomes scarce, intensifying competition among buyers.

Increasing construction costs can also impact house prices, as developers pass these costs onto purchasers. Moreover, strong household incomes contribute to greater demand for housing, potentially driving further price increases.

Overall, these factors combine to create a dynamic market in Canberra, where prices are subject to various influences.

Interest Rates and Their Impact on Canberra’s Market

Interest rates play a pivotal role in shaping Canberra’s property market. At the time of writing, the Reserve Bank of Australia has raised the cash rate 12 times and most recently, to 4.10% due to high inflation and tight labour markets. This has had a significant impact on the developing housing market recovery.

It is anticipated that interest rates will reach their highest point soon, but a substantial price increase is not expected in the immediate future.

At present, consumer confidence remains low, and many prospective homebuyers and investors are yet to take action. However, factors such as housing demand, supply, and the course of interest rates are likely to have a significant impact on the trajectory of home prices in the future.

Decisions Taken By The Reserve Bank

Decisions taken by the RBA to increase the cash rate in May 2022 had ramifications on Canberra’s property market by making borrowing more expensive and decelerating the market.

Predicting future interest rates can be challenging, yet economists anticipate the Reserve Bank’s rate increases might reach a peak this year and begin to drop in 2024, potentially leading to a rebound in the property market.

As investors navigate Canberra’s property market, it’s important for them to understand the implications of the Reserve Bank’s decisions. Specifically, they should be aware of the potential risks associated with rising interest rates, including higher borrowing costs and reduced demand for property.

Rise in Interest Rate and Property Prices

Increase in interest rates can diminish borrowing power and significantly increase minimum repayments, consequently causing a decrease in property prices. While interest rates have been increasing, they are only one of the many factors influencing property prices in Canberra.

Other factors, such as population growth, infrastructure projects, and government initiatives can also impact property prices. As rates continue to rise, investors must closely monitor these developments and adjust their strategies accordingly to succeed in Canberra’s property market.

Factors to Consider When Choosing a Property

- Key factors to consider when selecting a property in Canberra, such as location, amenities, and infrastructure.

- Understanding the potential growth prospects for property values in Canberra in the coming years.

As you venture into the property market in Canberra, it’s crucial to carefully consider several factors that can significantly influence your investment decisions. Understanding these factors will help you make informed choices and maximise the potential returns on your property investment.

Location, Amenities, and Infrastructure

The location of a property is one of the most critical factors to consider. Proximity to essential amenities such as schools, hospitals, public transport, and shopping centres can enhance the property’s appeal to potential tenants or buyers. Additionally, properties located in areas with well-developed infrastructure and future growth prospects tend to perform better over time. It’s essential to assess the neighbourhood’s amenities and infrastructure when evaluating potential properties for investment.

Potential Growth Prospects

Gaining insight into the potential growth prospects for property values in Canberra is essential for long-term investment success. Analysing historical property price trends and understanding the city’s economic prospects can help you gauge the potential appreciation of your investment. Look for areas with strong population growth, employment opportunities, and planned infrastructure developments, as these factors often drive property value appreciation.

Housing Affordability

Canberra offers a relatively affordable entry point for property investors, with the average proportion of income needed to meet mortgage repayments being less than 20%. This affordability can benefit investors looking to establish a foothold in the city’s property market. Moreover, the government’s efforts to address housing affordability by increasing housing supply may present further opportunities for investors.

Caution Towards Potential Risks

While Canberra presents promising investment opportunities, it’s essential to exercise caution and be aware of potential risks. For instance, high strata levies and buying off-the-plan properties might impact the profitability of investments. Thoroughly assess any risks associated with a specific property or investment strategy before deciding.

High-Performing Suburbs

Several suburbs in Canberra stand out as high-performing areas with promising investment potential. Suburbs like Chisholm, Dickson, Franklin, Ngunnawal, and Ainslie, among others, offer attractive investment opportunities. These suburbs may experience higher-than-average income growth, making them appealing to investors seeking long-term value appreciation.

The Property Buying Process in Canberra

- A step-by-step breakdown of the property buying process in Canberra, from property search to settlement.

- Common fees and costs associated with buying property in the area.

Purchasing a home is a major milestone, and it can be an exciting but overwhelming experience, especially if you’re a first-time homebuyer in Canberra.

If you’re considering buying a home, there are many factors to consider and decisions to be made, including, but not limited to, saving for a down payment, getting your credit in order, the size of the mortgage and finding the perfect home for your needs and requirements.

Investigate the Costs

When you are preparing to buy a property, it is essential to consider all the costs associated with the purchase.

There are several different fees and expenses that you will need to budget for, ranging from the purchase price of the property, the required deposit, and various government charges, legal and conveyancing costs, to moving expenses.

Ask Yourself: What Can I Really Afford?

Once you have a budget in place, we recommend trialling it for a few months to see how it feels, to ensure you still have enough to get by with daily life. Don’t forget to set aside some money for maintenance and repairs, that way you make sure not to stretch yourself too thin, and still enjoy your life.

When putting together your budget, it’s also vital to factor in upfront costs like stamp duty. When you feel confident about what you can afford, consider requesting pre-approval for a loan.

Do Your Homework

When buying a property, it’s always a good idea to be as informed as possible. So, take your time and get to know the neighbourhoods you’re interested in, as well as the type of house you’re after and the costs of similar homes. There are plenty of resource options to assist with this research such as CoreLogic, Realestate.com.au, and Domain.

Find the Value in Inspections

When looking at potential homes, it’s best to request a copy of the building report, if applicable, to review before inspecting the home in person.

Arranging an in-person inspection is highly encouraged, not only to judge whether the size of the home is compatible with your needs and requirements (or as a potential investment property) but also to locate any hidden issues like electrical problems or urgent repairs or unfinished renovations.

You can also consider hiring a property valuer to check things out, as they’re trained to identify any potential problems that you may miss.

Don’t Be Afraid to Negotiate!

Whether it’s the purchase price of the home or the terms of your mortgage, don’t be afraid to negotiate. You can often score a better deal by speaking up and advocating for yourself.

As a buyer, it’s important to feel in control during the negotiation process, and not be afraid to advocate for yourself. Every little bit counts, so don’t be shy about negotiating for the best price possible.

Keep in mind that real estate agents, while experts in their field for both sellers and buyers, ultimately work for the seller. They will do their best to assist you with suitable offers, to compete with other prospective buyers, but they may not have the flexibility to be lenient with the time given to decide on an offer price.

It’s perfectly okay to take a moment to consider all of your options before proceeding, even if this means losing out to a competitor, as you will feel more secure in making a well-thought-out decision than one made under pressure.

Work with a Real Estate Agent

Buying a home is a big deal and can be an emotional rollercoaster, with lots of excitement, stress and fear. It can also be a massive time, money and energy commitment.

To find the right property for YOU, it’s important to know what you need and what you can afford and compare that to what’s on the market when you’re ready to buy.

Working with an experienced agent can make all the difference in this process, as a sales agent will know all the ins and outs of what to look for and how to find the perfect fit for you.

Financing Your Property Purchase

- Exploring financing options available for property buyers in Canberra.

- How much deposit do you need to buy a house in Canberra?

If you’re a first-time homebuyer, you might be able to get some financial assistance to help you out. Here are a few options that might be worth looking into:

As you embark on your journey to purchase a property in Canberra, understanding the financing options available and the required deposit amount is crucial for a successful home purchase.

Saving for a Deposit

Before you begin exploring financing options, it’s essential to determine how much you can borrow from a lender and calculate the deposit you’ll need. Typically, a deposit of around 20% of the property’s total price is recommended.

While some lenders may accept a lower deposit, keep in mind that this could lead to more stringent conditions on your mortgage. Hence, it’s advisable to save as much as possible for a substantial deposit.

Securing a Home Loan

If you find it challenging to gather a 20% deposit, you might incur lenders’ mortgage insurance, which can be significantly costly. To navigate these financial aspects smoothly, seek guidance from the team at Jonny Warren Properties.

Stamp Duty Concessions

Some state and territory governments offer incentives to first-time homebuyers, including stamp duty concessions. Research what’s available in the area you’re buying in.

First Home Guarantee Scheme

The First Home Guarantee (FHBG) is a part of the Australian Government’s Home Guarantee Scheme (HGS), which aims to assist eligible home buyers in acquiring a home sooner.

Through the FHBG, the NHFIC provides a guarantee on a portion of the home loan, allowing eligible buyers to purchase a home with as little as a 5% deposit and without the need for Lenders Mortgage Insurance. This guarantee is applicable for up to 15% of the property’s value as assessed by the lender. It’s important to note that this guarantee isn’t a cash payment or a deposit for the home loan; rather, it acts as added security for the lender, enabling buyers to enter the housing market with reduced barriers.

First Home Super Saver Scheme

Under the First Home Super Saver Scheme (FHSSS), eligible first-time homebuyers can withdraw voluntary super contributions (made since July 1, 2017) of up to $50,000 for individuals or $100,000 for couples (plus associated earnings/less tax) to put towards a home deposit. Find out more about whether you might be able to withdraw under the FHSSS.

There are a number of financial assistance options available to first-time homebuyers in Canberra. It’s worth taking the time to research these options and see if you might be eligible to take advantage of any of them as you start the process of purchasing your first home.

Hidden Costs When Buying Your First Home

When purchasing your first home in the ACT, it’s important to be prepared for the reality of unavoidable fees that come with the process.

Let’s explore some of these fees:

Stamp Duty Reforms

The ACT government embarked on ambitious stamp duty reforms in 2012, aiming to phase out transfer duty over a 20-year program. At the end of this program, transfer duty will no longer be payable in the territory, making the ACT the first jurisdiction in Australia to achieve this milestone.

As a result of the reforms, the ACT’s dependence on stamp duty revenue has decreased from 20% to 13%, indicating a more balanced and sustainable approach to property taxation. Recent Domain analysis shows that Canberra and Brisbane now have the lowest stamp duty rates among the capital cities.

First-home buyers in the ACT are also given significant support, as they are exempt from paying stamp duty on any property purchase if their annual household income is less than $160,000.

However, while stamp duty has been reduced or removed, the government has implemented rate hikes to replace conveyance duty taxes with rates. As a consequence, there have been substantial increases in rates for both houses and units in recent years.

Land Tax

In the ACT, land tax is a fixed charge of $1,090 for all properties and is assessed quarterly in July, October, January, and April. Use the calculator to ascertain your precise land tax amount.

Legal Fees

Legal fees for the complexity of your contracts can range from $500 to $3,000. Consulting a solicitor or conveyancer can help you understand these fees in greater detail.

Lender’s Fee

Some lenders may charge a fee of up to $1,000 when applying for a loan, but it might be waived in some cases.

Property Valuation

Expect to pay around $300 to $500 for an independent property valuation service.

Lenders Mortgage Insurance

If borrowing more than 80% of the property’s price, lenders mortgage insurance may apply, averaging around $10,000. This insurance provides the lender with protection if you face difficulties in repaying the loan.

Understanding and preparing for these fees is essential to budget effectively and make informed financial decisions throughout the property purchase process.

The Rental Market and Investment Opportunities

- Insights into the rental market in Canberra and opportunities for investment properties.

- Factors to consider when investing in rental properties.

The rental market in Canberra is thriving, presenting promising investment opportunities for those looking to capitalise on the city’s strong rental demand and attractive rental yields. Let’s explore the current landscape of Canberra’s rental market and the factors to consider when investing in rental properties.

Canberra’s Rental Market Landscape

With a vacancy rate of 1.4% and rental yields rising to 4.19%, Canberra’s rental market is robust and favourable for investors seeking rental income in a thriving capital city. Certain areas, particularly in the south, such as Mawson and Hawker, demonstrate promising rental yields. Additionally, luxury units cater to high-earning Canberrans seeking premium living experiences.

Vacancy Rates and Rental Demand

The low vacancy rate of 1.4% indicates strong demand for rental properties in Canberra. Several factors contribute to this rental demand, including population growth, infrastructure projects, government initiatives, and interest rates. As Canberra’s population grows and infrastructure projects develop, the demand for rental properties is expected to rise, sustaining a robust rental market. Investors should closely monitor these factors to seize investment opportunities in the city’s rental market.

Rental Yields in Canberra

Rental yields refer to the return on investment for rental properties, calculated by dividing the annual rental income by the property’s purchase price. The median rental yield for houses in Canberra is 3.62%, while the overall gross rental yield across all dwelling types is 3.76%.

High-performing suburbs such as Chifley, Curtin, Harrison, Mawson, and Lyons offer the highest rental returns for units in Canberra. Investors seeking attractive rental yields should consider these suburbs to maximise their rental income in the thriving rental market.

Housing Values and Rental Markets

Canberra remains the most expensive capital city to rent a house, with median weekly rents at $690. The median rental average for all dwellings in Canberra is $633 per week, representing a 1.5% increase from the previous quarter.

This upward trend in rental averages reflects the strength of Canberra’s rental market, influenced by population growth, infrastructure projects, and government initiatives. Notably, the ACT government implemented major rental reform on 1 April 2023, granting tenants additional rights by eliminating ‘no cause’ evictions from the Residential Tenancy Act 1977.

This initiative underscores the government’s commitment to addressing rental market issues and promoting a fair and balanced market in Canberra, potentially leading to more affordable rental opportunities.

Investors looking to enter Canberra’s rental market should carefully analyse rental yields, demand trends, and government initiatives to make well-informed investment decisions that align with the city’s evolving rental landscape.

Special Considerations and Regulations

- Understanding land tax in Canberra/ACT and its implications for property owners.

When it comes to property ownership in Canberra, understanding the land tax implications is crucial for managing your property ownership and potential land tax liabilities effectively.

Let’s explore the changes to land tax for ACT residential properties and the exemptions that may apply to property owners.

Changes to Land Tax for ACT Residential Properties

Substantial changes to the ACT land tax system for residential properties were implemented on 1st July 2018, which have important implications for property owners in Canberra.

Land Tax (Unimproved Land Value)

Land tax in the ACT is payable on all investment properties. It is calculated based on the unimproved land value of each individual property, rather than being aggregated across all property assets.

The land tax consists of two components: a fixed charge of $1,263 and a valuation charge, which is calculated by applying a rating factor to the average unimproved value of the property. Property owners should be aware of their land tax obligations, especially when considering investment opportunities in the ACT’s property market.

New Land Tax Regime

In the past, only residential properties that were rented out were subject to land tax in Canberra. However, the landscape has changed, and now all ACT residential properties are liable for land tax, with a few exemptions. Notably, properties that are left vacant, even if unrented, are now subject to land tax—a change that deviates from the previous practice.

Exemptions from Land Tax

Certain property owners may be exempt from paying land tax if they meet specific criteria. The following categories qualify for exemptions:

Principal Place of Residence

If the property is used by the owner as their principal place of residence, and they were residing in the property on the first day of the quarter (i.e., the first of January, April, July, or October), they may be exempt from land tax.

Property Purchase for Principal Place of Residence/Moving In

Owners purchasing a property to use it as their principal place of residence may also be exempt from land tax.

Ceasing to Be Principal Place of Residence/Moving Out

If the owner moves out of the property, making it no longer their principal place of residence, they may be exempt from land tax.

Death of an Owner

In the unfortunate event of the death of an owner, and if the property was their principal place of residence, an exemption from land tax may apply.

Inability to Live Independently

If the property was the owner’s principal place of residence, but they can no longer live independently in that property, they may qualify for an exemption.

Unfit for Occupation

An exemption from land tax may be applicable if the property is deemed unfit for occupation.

Occupied Rent-Free or for ‘Nominal’ Rent

If the property is occupied by a person without payment of rent or for ‘nominal’ rent, the owner may be exempt from land tax.

It’s essential to note that if the property is owned by a company or a trustee, land tax is generally payable on the property.

99-Year Leases in Canberra

- An in-depth look at the 99-year lease system in Canberra and why it exists.

- What happens when the 99-year lease expires, and how it impacts property owners.

The property landscape in Canberra is unique, with all residential land in the nation’s capital being leasehold. Let’s take an in-depth look at the 99-year lease system in Canberra, why it exists, and what happens when the 99-year lease expires.

The 99-Year Lease

In Canberra, individuals do not technically buy land; instead, they enter into a 99-year lease agreement for residential land. This leasehold system means that property owners have exclusive use and possession of the land for 99 years.

However, unlike traditional rental arrangements, property owners don’t pay a weekly fee, and they won’t get evicted as long as they adhere to lease conditions.

The origin of the 99-year lease system dates back to the early development of the Australian Capital Territory (ACT) in the 1920s. Despite the passing of many decades, the first instances of leases expiring are not expected until 2023. Upon the expiration of a lease, leaseholders have the option to renew their leases for another 99 years by paying a small fee.

This system provides long-term security and stability to property owners and helps maintain a continuous and sustainable property market in Canberra.

Long-Term Outlook for Canberra’s Property Market

The future of Canberra’s property market holds promise and potential, with several factors contributing to its sustained growth and stability, such as:

Anticipated Growth Areas

Looking ahead to 2060, certain regions in Canberra are expected to experience significant growth. The inner north, Molonglo Valley, and Belconnen areas are projected to be at the forefront of rapid development and urban expansion.

Future Property Price Trends

While Canberra’s property market is projected to experience a 9% decrease in property prices in 2023, following a 7% decrease in 2022, there is optimism for a rebound in the subsequent years. With potential interest rate reductions, property prices are anticipated to rise by 10% in 2024 and continue to grow into early 2025.

These projected price trends suggest that Canberra’s property market may undergo a period of fluctuation, necessitating careful monitoring and adaptability on the part of investors. Staying informed about market conditions and being flexible in investment strategies will be vital for navigating the evolving property landscape in the coming years.

Other Key Factors Shaping the Market

Several other key factors will play a crucial role in influencing the Canberra property market’s performance beyond 2023. These include:

- Home Buying Capacity and General Economic Health

- Supply and Demand

- Inflation and Interest Rates

- Government Incentives and Land Tax

- Infrastructure Projects

- Population Growth and Housing Demand

Frequently Asked Questions

Are house prices dropping in Canberra?

Yes, recent data indicates that Canberra’s housing market is experiencing a decline, with house prices dropping significantly from their peak. This suggests a downward trend in the capital city’s housing market. However, it’s important to note that market conditions can change, and this drop could be temporary.

What is the median house price in Canberra in 2023?

Projections for 2023 show that house prices in Canberra will continue to decline, with the median house price estimated at $871,949. This represents a decrease of 9% compared to the previous year’s figure.

Are unit prices dropping in Canberra?

Yes, available evidence indicates that unit prices in Canberra are indeed decreasing. Suburbs like Macquarie and Cook have experienced the biggest declines, with drops of 11.5% and 8.7%, respectively. Overall, the median value across Canberra units has dropped by 0.5% in the past 12 months.

When will Canberra house prices rise?

Based on current market data and QBE forecasts, it is likely that median house prices in Canberra will rise in the next three years. Projections indicate that prices could increase by 2.4% over that period, suggesting potential growth in the short-term.